Country Italy 🇮🇹

Descriptions

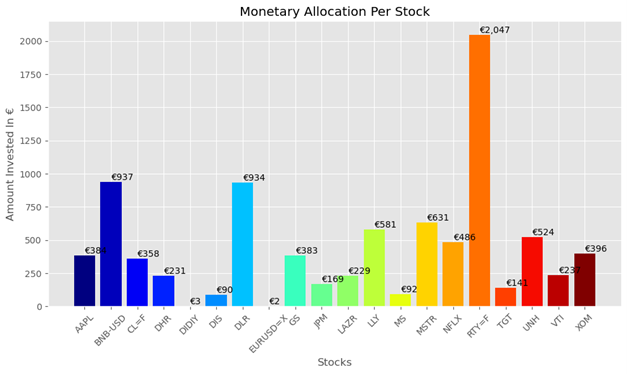

The bar graph provided showcases the monetary allocation for each stock within a portfolio management project. The strategy focuses on maximizing returns, and the graph reflects a diversified investment approach. Here’s a professional description of the results:

- Diversification Strategy: The graph indicates a strategic distribution of investments across various stocks, with TGT receiving the highest allocation at €2,047, suggesting a strong confidence in its return potential.

- Significant Investments: Other notable allocations include AAPL and DLR, with investments of €937 and €934 respectively, demonstrating a balanced approach to risk and potential gains.

- Investment Spread: The varying amounts invested, from €23 in YT1 to €2,047 in TGT, illustrate the project’s methodical and tailored investment decisions to optimize the portfolio’s performance.

This allocation reflects a well-considered strategy aimed at achieving the best possible returns while managing risk through a spread of investments across different assets. The graph serves as an effective visual tool for communicating the project’s investment decisions and outcomes.