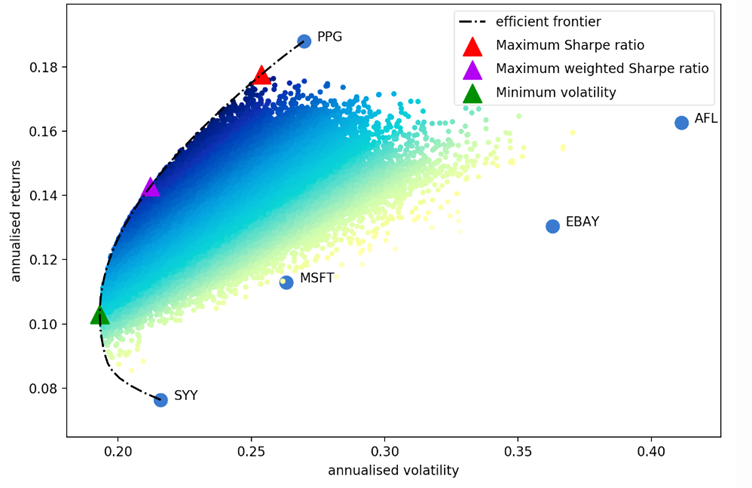

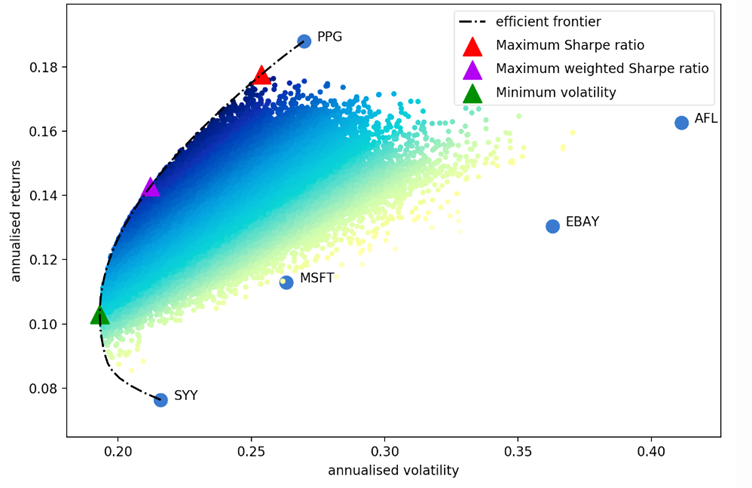

This project is centred around modern portfolio management and the efficient frontier concept. It optimises investment strategies by balancing expected returns against associated risks, ensuring optimal asset allocation for maximized gains and minimized volatility.

The provided image is a scatter plot graph representing annualized returns versus annualized volatility. Various coloured dots fill the plot, indicating different return and risk levels. A black dashed line indicates the efficient frontier, representing portfolios that offer the highest expected return for a specific level of risk. Four distinct markers represent different portfolio compositions: Maximum Sharpe ratio (PPG), Maximum weighted Sharpe ratio (not labelled), Minimum volatility (SYY), and another point on the efficient frontier (MSFT). Two additional blue circles labelled “EBAY” and “AFL” are plotted but are not part of the efficient frontier.