Country Italy 🇮🇹

Descriptions

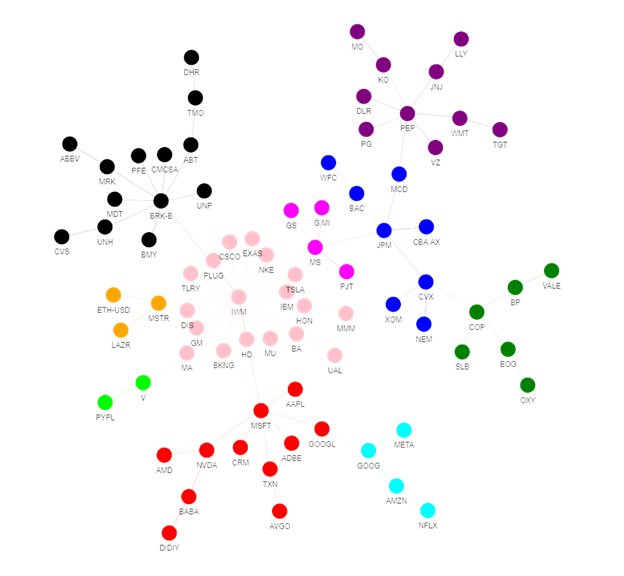

The project depicted in the graph is an innovative approach to portfolio management, leveraging advanced graphical machine learning techniques to optimize stock selection. Here’s a professional description of the project:

- Strategic Clustering: The project begins with a comprehensive portfolio, which is then refined by clustering stocks using graphical machine learning techniques. This process groups stocks with similar performance characteristics, allowing for a more focused and effective portfolio.

- Graph-Based Algorithms: Techniques such as Node2Vec and other graph-based algorithms are employed to analyse the interconnectedness and relationships between stocks. This analysis aids in understanding the market structure and identifying key investment opportunities.

- Efficient Diversification: By clustering stocks, the project aims to create a smaller, more efficient portfolio that maintains diversification while potentially enhancing returns. The goal is to strike a balance between risk and reward by carefully selecting a mix of assets.

- Optimal Allocation: The final step involves using the insights gained from the clustering process to determine the best monetary allocation for each stock. The objective is to maximize returns based on the identified clusters and their respective performance predictions.

Overall, this project represents a sophisticated and data-driven approach to portfolio management, utilizing cutting-edge technology to inform investment decisions and achieve financial goals. The graph serves as a testament to the project’s analytical rigor and strategic asset allocation.