Country Norway 🇳🇴

Descriptions

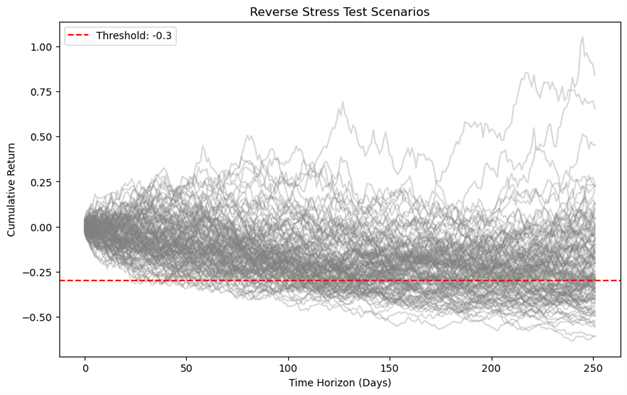

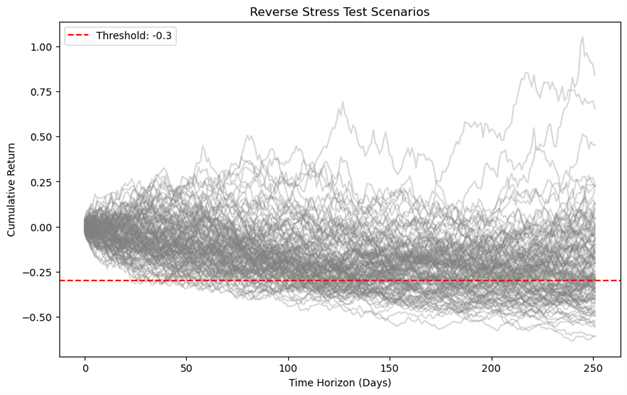

The project is a comprehensive risk management initiative that employs reverse stress testing to evaluate the robustness of a financial portfolio.

- Reverse Stress Testing: This technique involves simulating a range of adverse scenarios to determine the portfolio’s potential losses. It helps identify the conditions under which the portfolio would fail to meet its objectives.

- Risk Threshold Identification: By establishing a critical threshold, such as a -0.3 cumulative return, the project can pinpoint the exact scenarios that would lead to unacceptable losses.

- Scenario Analysis: The project analyses multiple scenarios, represented by grey lines on the graph, to assess the portfolio’s performance over a 250-day time horizon.

- Risk Mitigation Strategy: The insights gained from this testing enable the formulation of strategies to pre-emptively address vulnerabilities and strengthen the portfolio against market volatility.

Overall, this project exemplifies a strategic approach to risk management, ensuring that the portfolio is equipped to withstand challenging market conditions and safeguard investments. The use of reverse stress testing is a proactive measure to enhance financial resilience.